Birkenstock is the latest firm looking to test the IPO waters, as the iconic sandal maker eyes a deal that could value the company at more than $8 billion.

Family footsteps

Birkenstock can trace its first steps back to 1774 when Johann Adam Birkenstock, a “subject and cobbler”, plied his trade in a small German village. However, it was his grandson Konrad, who in introduced the first footbed with contoured arch support in 1902, and it was his son, Karl, who’s credited with creating the first Birkenstock sandal. The long tradition of family ownership came to an end in 2021 when L Catterton, a private equity firm backed by luxury giant LVMH, acquired a majority stake in the shoe company for €4 billion ($4.3 billion).

The company got a foothold in the US market thanks to German dressmaker, Margot Fraser. Returning to California after a trip to Germany — with a few pairs of Birkenstocks packed into her suitcase — Fraser began distributing Birks in the US. But, despite their comfort, she struggled to convince retailers to stock them, before eventually finding an unexpected home for the sandals in health stores, where they became associated with the hippie movement. Today, the US accounts for more than half of Birkenstock’s sales.

Birkenstock stock

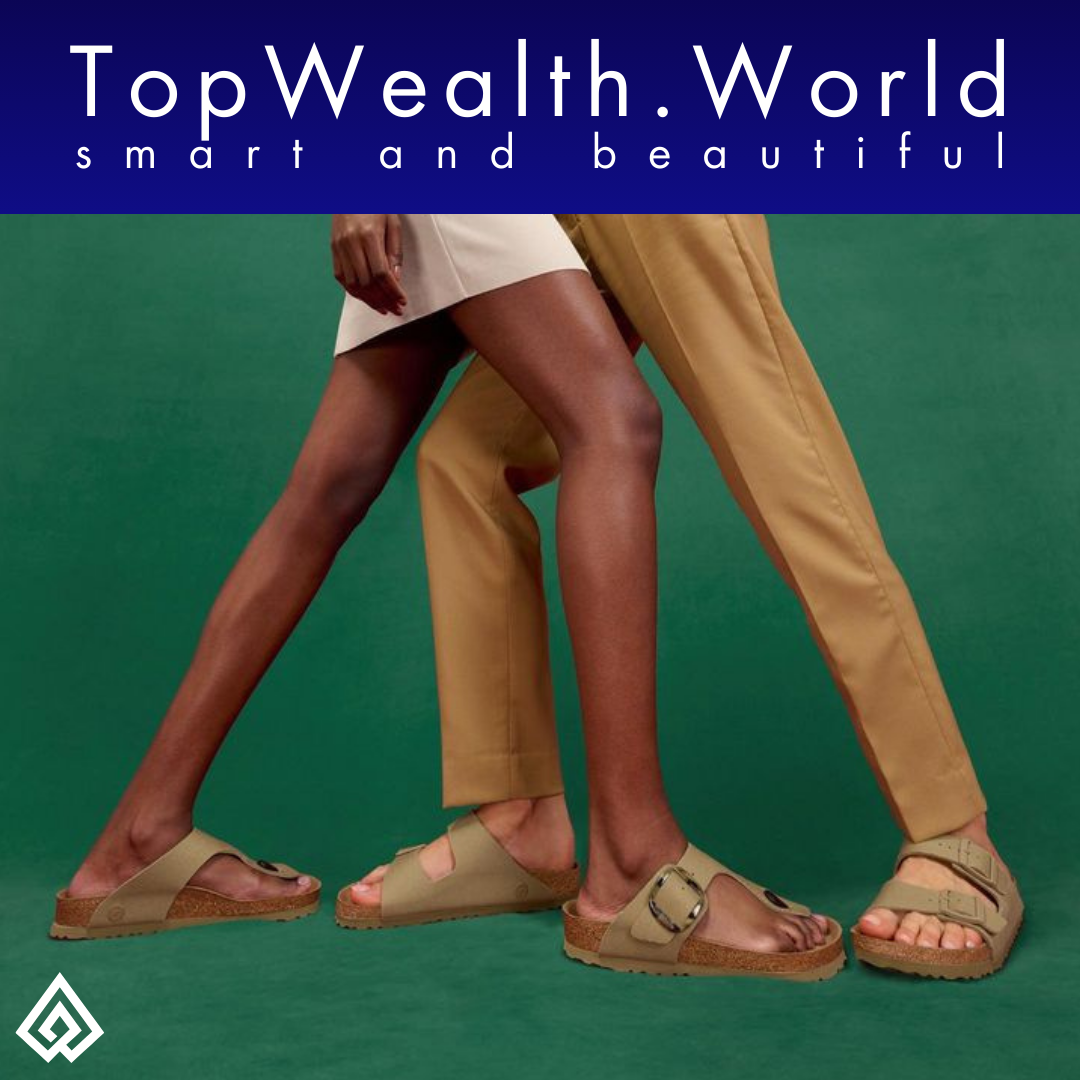

Birkenstock’s more recent transformation, from humble sandal to fashion icon, has been marked by collaborations with designers such as Christian Dior, Manolo Blahnik, Stüssy, and Valentino Garavani, with its moment in the spotlight elevated by a cameo in this summer’s blockbuster, Barbie. The results speak for themselves, with sales more than quadrupling since 2014.